In a Govt pampered PR event, it was announced few weeks back that RBI had stepped to save the bleeding economy from effects of COVID-19 pandemic including some big measures and guidelines for real estate and capital finance predators.

The RBI said all term loans of all banks and lenders are permitted to grant a moratorium of three months on payments of all installments falling due between March 1, 2020 and May 31, 2020. The repayment schedule of these loans will be shifted across the board by three months after the moratorium period.

It essentially means borrowers won’t have to pay EMIs during the moratorium period and it won’t be deducted from their bank accounts. Further the interest will continue to accrue on the outstanding part of the loan during the moratorium period.

If consumers choose to avail the benefit of moratorium, borrower’s so-called credit rating will not be impacted. All of this in paper and rule books, what happens in practice only those millions of suffering locked lot can have any say!

Indian Real Estate financing and unethical banking has been marred by unprofessional and fraudulent processes over many decades now. There is no sanctity in transactions or systematic approach to processes, most of their actions and announcements are highly random and mostly opportunistic for its premium stakeholders benefit ONLY. We can narrow down various issues in to following key points:

1. Non-transparent procedures, exploitative interest rates

2. Distasteful approach of many Builders / Brokers / Bank Agents

3. Non-adherence of time in most of the procedures

4. Overall unsatisfying & unhappy experience

Only by putting sincere efforts with professional, honest and transparent approaches, can any govt ease transaction process in today’s highly greedy Real Estate and Banking Industries. For any transaction it is very important to have following features;

1. Transparency

2. Process Driven

3. Time-Bound

4. Professional

5. Hassle Free

With these services, we can bring a great change in this Industry. Government of India has passed RERA bill to bring in more transparency and accountability in every deal thus bringing complete satisfaction to the customer. With the RERA bill in effect, builders, financiers and Service Providers were bound by laws to deliver what they commit to their customers. Is this the reality now?

2 thoughts on “RBI COVID-19 measures & rescue guidelines are real or PR gimmick?”

Leave a Reply

You must be logged in to post a comment.

Dear Service Provider,

Greetings from your borrower.

I’m facing an unprecedented situation with the COVID-19 (Novel Coronavirus) Pandemic in the country. I’m committed to the health, safety and well-being of my clients, friends and dependent families. I am unable to pay your current and future demands as I’m operating with reduced incomes. I urge you to use restraint, reduce your costs, interests and modify your SOPs, banking demands and non-essential needs.

You may visit my blog profile to know more.

Link: https://www.wisepoint.org

In case you require urgent assistance with respect to EMIs, dues or other security concerns, please call between 11:00 to 15:00 hrs to registered mobile number or write an email. No replies, fancy calls or those ready-made auto-responses will be considered as ignorance and illegal practice.

Thanks and Regards,

Your Suffering Customer

A Common Borrower

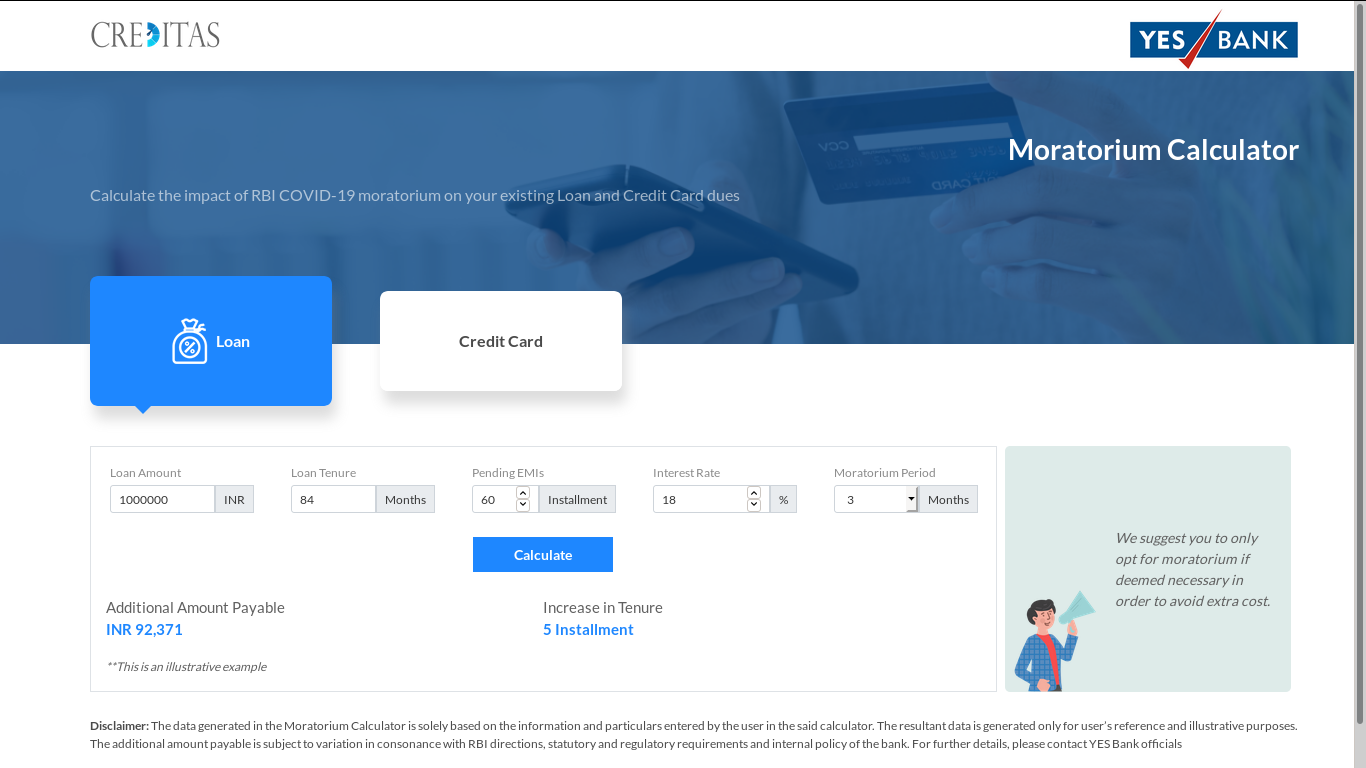

COVID-19 Rescue or Trap? Flyers by same banks blatantly advising consumers to opt for RBI moratorium ONLY if necessary to avoid extra bucks we the capitalists will extort now or in future (whatever the working class say or assume), just like our good golden decades of killer corporate mayhem and get rich soon strategies! https://paymentadvisors.in/moratoriumCalcYes